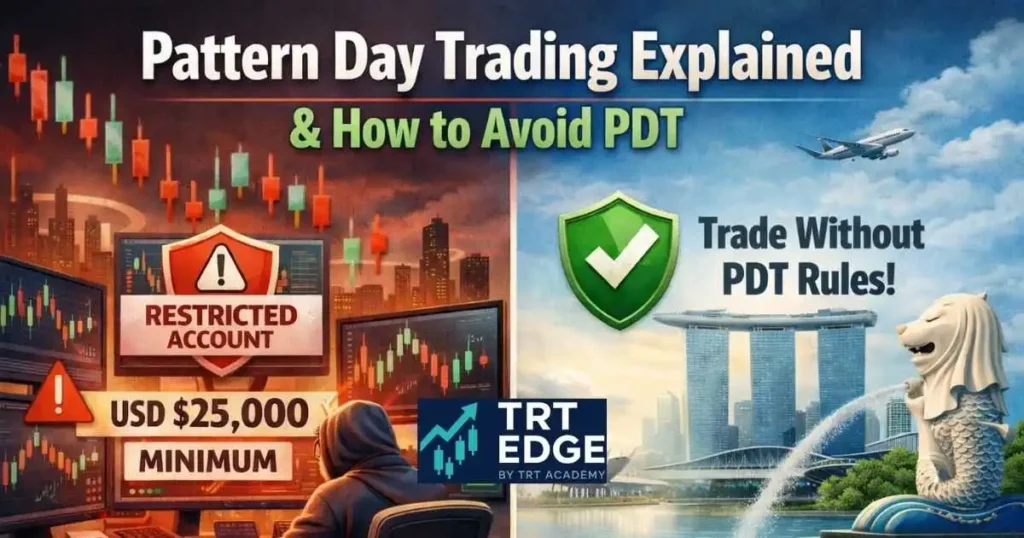

Pattern Day Trading Explained & How to Avoid PDT

Pattern day trading is one of the most misunderstood rules among active traders in Singapore—especially beginners trading U.S. stocks. If you’ve ever had your account restricted after making several short-term trades, you’ve likely encountered the Pattern Day Trading (PDT) rule.

In this guide, we’ll explain what is pattern day trading, how pattern day trading works, the pattern day trading rules, and—most importantly—how to avoid pattern day trading legally by using MAS-regulated brokers.

What Is Pattern Day Trading?

Pattern day trading refers to a U.S. regulatory rule that applies to traders who execute four or more day trades within five business days in a margin account, provided those trades exceed 6% of total trading activity.

This rule is enforced by FINRA (U.S.) and primarily affects traders using U.S.-regulated brokerage accounts.

How Does Pattern Day Trading Work?

To understand how pattern day trading works, here’s a simple example:

- You buy and sell the same stock on the same day → 1 day trade,

- You repeat this 4 times within 5 trading days, and

- Your account is flagged as a Pattern Day Trader.

Once flagged:

- You must maintain USD 25,000 minimum equity, and

- Failure to do so can result in account restrictions or trading bans.

This rule often limits smaller traders who want to trade actively.

Pattern Day Trading Rules You Must Know

Key pattern day trading rules include:

- Applies only to U.S. margin accounts,

- Requires USD 25,000 minimum equity,

- Violations can lead to 90-day trading restrictions, and

- Cash accounts are treated differently but still have settlement limits.

For many traders outside the U.S., these rules can feel unnecessary and restrictive.

How to Avoid Pattern Day Trading (Legally)

If you’re wondering how to avoid pattern day trading, the most effective solution is to trade through MAS-regulated brokers in Singapore.

Why?

Because trading through MAS-regulated platforms is not subject to U.S. FINRA pattern day trading rules for Singapore-based accounts, even when trading U.S. stocks.

MAS-Regulated Brokers That Help You Avoid PDT

Here are trusted platforms used by our community of traders in Singapore:

🔹 Saxo Markets

- Professional-grade trading tools

- Access to global markets

- Ideal for active and advanced traders

👉 Open a Saxo Markets account and trade without PDT constraints

🔹 Webull Singapore

- User-friendly platform

- Low commissions

- Popular among active traders and beginners

👉 Open a Webull account today and trade freely

🔹 Tiger Brokers

- Competitive fees

- Strong trading app

- Access to U.S., HK, and global markets

👉 Start trading with Tiger Brokers and avoid PDT rules

🔹 Longbridge Securities

- Modern interface

- Designed for frequent traders

- Strong regional support

👉 Open a Longbridge account and trade without PDT limits

✅ These brokers operate under MAS regulations, meaning pattern day trading rules do not apply in the same way as U.S.-regulated brokerage accounts.

Final Thoughts: Trade Actively Without PDT Stress

Understanding pattern day trading rules is crucial—but avoiding unnecessary restrictions is even more important.

If you want the freedom to:

- Trade actively

- Day trade without USD 25,000 minimum equity

- Avoid account freezes and violations

Then choosing a MAS-regulated broker like Saxo Markets, Webull, Tiger Brokers, or Longbridge Securities is a smart and compliant solution.

👉 Open your account today and trade without pattern day trading limitations.