Futures Trading on Webull Singapore: Trade Global Markets

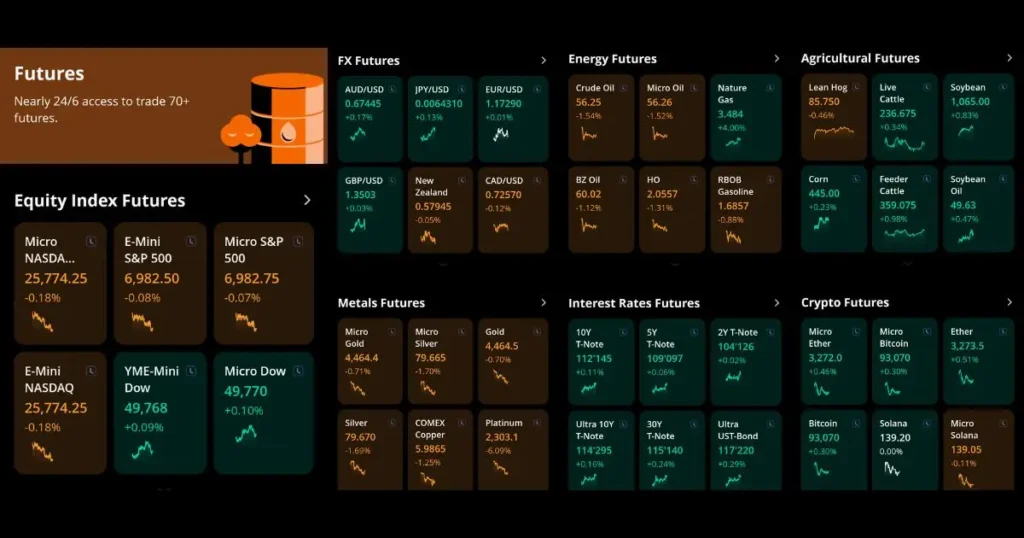

Futures trading has officially arrived on Webull Singapore, giving traders access to global derivatives markets with powerful tools, transparent market structures, and institutional-grade execution—all within a single platform.

If you’re researching what is futures trading, evaluating commodity futures trading commission, or planning to trade specific markets such as copper futures trading or soybean futures trading, Webull Singapore now offers a streamlined way to participate in global futures markets.

What Is Futures Trading?

Futures trading involves buying or selling standardized contracts that obligate the trader to transact an underlying asset at a predetermined price on a future date. These contracts are traded on regulated exchanges and are commonly used for:

- Hedging against price volatility,

- Speculation on market direction, and

- Diversification beyond equities.

Futures markets cover indices, energy, metals, and agricultural commodities—making them a core instrument for active and professional traders.

Futures Trading on Webull Singapore: What Makes It Stand Out

Webull Singapore brings futures trading to a modern, data-driven platform designed for precision and speed.

Key Advantages

- Access to Global Futures Exchanges

Trade major futures contracts across commodities and indices. - Transparent Commodity Futures Trading Commission Structure

Futures markets are regulated in the U.S. by the Commodity Futures Trading Commission (CFTC), which oversees futures exchanges, clearing organizations, and market participants to promote transparency, integrity, and fair pricing. - Advanced Trading & Charting Tools

Professional-grade charts, indicators, and real-time data. - All-in-One Trading Platform

Trade stocks, ETFs, options, and futures from a single Webull account.

Understanding Commodity Futures Trading Commission (CFTC)

When traders talk about commodity futures trading commission, it often refers to the Commodity Futures Trading Commission (CFTC)—the U.S. federal regulator responsible for overseeing futures, options on futures, and swaps markets.

The CFTC’s role includes:

- Ensuring market transparency and integrity,

- Reducing systemic risk, and

- Protecting market participants from fraud and manipulation.

For traders accessing U.S. futures markets through platforms like Webull, CFTC oversight provides confidence that futures exchanges operate under strict regulatory standards.

Trade Key Commodity Futures on Webull

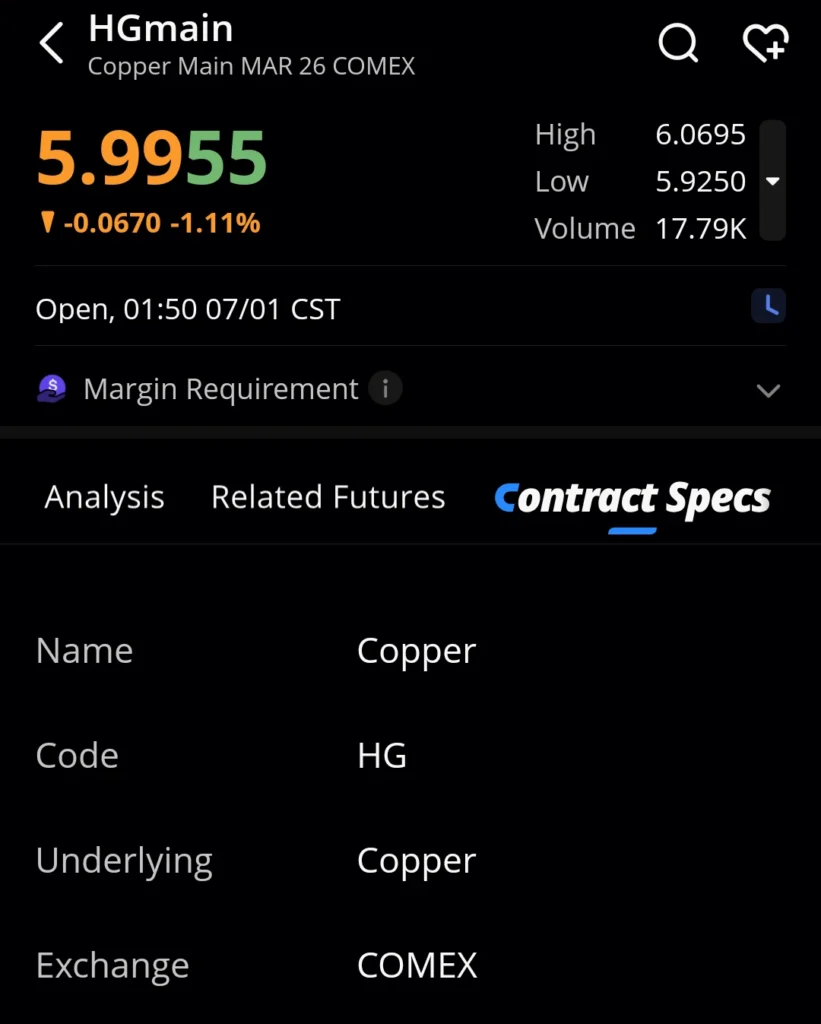

Copper Futures Trading

Copper futures trading is closely followed by traders worldwide because copper is widely used in construction, manufacturing, and electrification. As a result, copper prices often reflect global economic health and industrial demand trends.

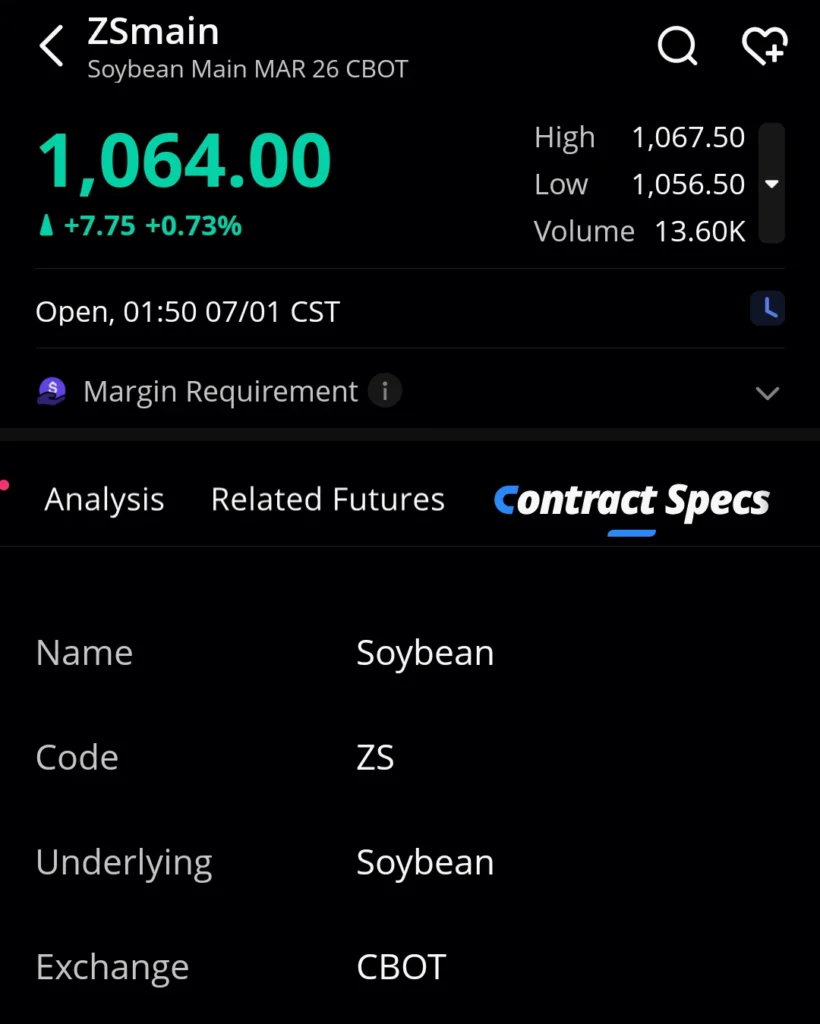

Soybean Futures Trading

Soybean futures trading offers exposure to agricultural markets influenced by weather patterns, global consumption, export demand, and geopolitical developments. These contracts are popular among both speculators and hedgers.

Webull Singapore enables traders to monitor these commodity markets in real time and execute trades efficiently.

Who Should Consider Futures Trading?

Futures trading may be suitable for:

- Active traders seeking short-term opportunities,

- Investors hedging exposure to commodities or indices, and

- Experienced traders using leverage strategically.

Because futures are leveraged instruments, they involve higher risk and are best approached with proper risk management and market understanding.

Start Futures Trading on Webull Singapore

Opening a Webull account is fully digital and straightforward. Once approved, you’ll gain access to futures markets alongside advanced analytics and execution tools designed for active traders.

👉 Open a Webull account today and access futures trading on Webull Singapore.