Crypto CFDs: Key Differences vs Actual Cryptocurrencies

On 3 December 2025, FOREX.com officially launched cryptocurrency CFDs, expanding its product suite to give traders flexible, leveraged access to the crypto markets. With near-24/7 trading availability and a broad list of tradable crypto instruments, this update creates new possibilities for both Accredited and Retail investors.

However, many traders still ask:

“How do crypto CFDs differ from buying actual cryptocurrencies?”

This blog breaks it down clearly—plus everything you need to know about FOREX.com’s latest offering.

24/7 Trading for Crypto CFDs

FOREX.com’s cryptocurrency CFDs trade seven days a week, with only a brief weekly maintenance window:

Market Hours (SGT):

- Closes: Saturday, 6am SGT (Friday, 10pm UTC).

- Reopens: Saturday, 5pm SGT (Saturday, 9pm UTC).

This gives traders the freedom to react to news and volatility even during weekends—when major crypto events often occur.

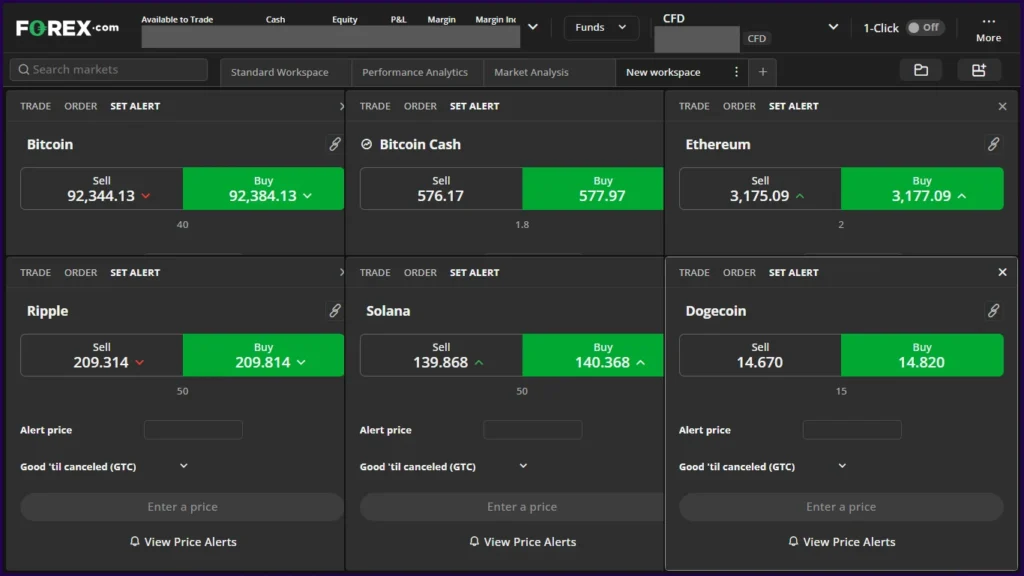

Cryptocurrency CFDs Now Available

Starting 3 December 2025, traders can access a wide range of crypto CFDs, including major assets and popular altcoins:

- Bitcoin (BTC).

- Bitcoin Cash (BCH).

- Ethereum (ETH).

- Ripple (XRP).

- Solana (SOL).

- Dogecoin (DOGE).

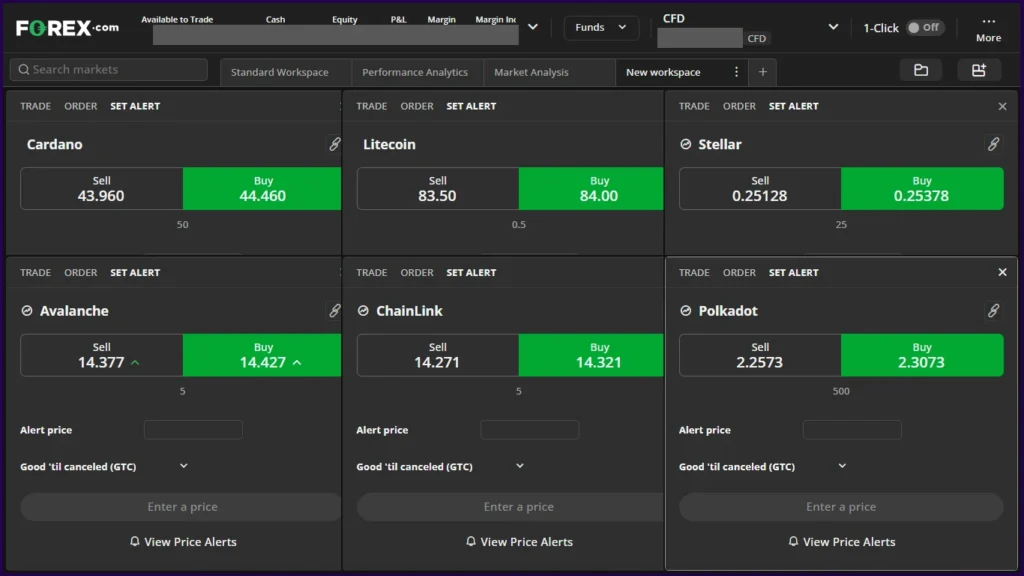

- Cardano (ADA).

- Stellar (XLM).

- Litecoin (LTC).

- Avalanche (AVAX).

- ChainLink (LINK).

- Polkadot (DOT).

- Uniswap (UNI).

- Aave (AAVE).

- Curve DAO Token (CRV).

This list provides exposure across blue-chip cryptocurrencies, layer-1 ecosystems, and DeFi-related projects.

How Do Crypto CFDs Differ from Buying Actual Cryptocurrencies?

Understanding the difference between these two approaches is essential for choosing the right product for your trading goals.

1. You Don’t Hold the Actual Coins

With Crypto CFDs, you’re trading price movements—not owning the digital asset.

Actual crypto purchases involve taking ownership, storing coins in a wallet, and potentially using them within blockchain ecosystems.

2. Leverage vs Full Upfront Capital

- Crypto CFDs: Trade with leverage (subject to regulatory limits):

- Accredited investors: Margin from 25%.

- Retail clients: Margin from 50%.

- Actual cryptocurrencies: Must pay the full price upfront.

3. Ability to Trade Both Directions

- Crypto CFDs: Go long or short easily.

- Actual crypto: Typically profitable only when prices rise.

4. Regulated Broker vs Crypto Exchanges

- Crypto CFDs: Offered through a regulated broker framework.

- Actual crypto: Purchased on exchanges with varying regulatory oversight.

5. No Wallets or Blockchain Management Needed

- Crypto CFDs: No private keys, seed phrases, or blockchain security concerns.

- Actual crypto: Requires safe wallet practices and technical knowledge.

Which Approach Suits You Best?

Crypto CFDs may be ideal if you want:

✔ Short-term opportunities.

✔ Leverage.

✔ The ability to short the market.

✔ Regulated broker execution.

✔ No technical hassle of wallets.

Buying actual cryptocurrencies may suit you if you want:

✔ Long-term holding.

✔ Digital asset ownership.

✔ Use of tokens in DeFi, staking, or Web3 applications.

Both methods have a place—your choice depends on your strategy and risk tolerance.

Ready to Trade Crypto CFDs?

Open Your FOREX.com Account Today!

Take advantage of:

✔ Near-24/7 crypto market access..

✔ Competitive margin requirements

✔ A trusted, established global broker.

✔ A wide range of cryptocurrency CFDs.

Start your trading journey with FOREX.com and explore new opportunities in the fast-moving crypto market.

Important Risk Disclaimer

Cryptocurrencies are not legal tender or securities. Cryptocurrencies and Cryptocurrency Contracts For Differences (CFDs), which are derivatives of cryptocurrency, are not regulated by the Monetary Authority of Singapore (MAS). Investors should be aware that they are not entitled to any legislative protection when they deal with Cryptocurrency CFDs.

If you choose to invest in unregulated products, you will not be protected under MAS regulations. Other risks associated with trading Cryptocurrency CFDs include high price volatility, lack of price transparency, cybersecurity risks, and the unregulated status of payment token spot trading markets.

Please ensure that you are fully aware of the risks involved in cryptocurrencies. If in doubt, you should consult an independent financial adviser. For more information on cryptocurrency risks, visit the MoneySense website.