BOJ Rate Hike Spurs Yen Carry Trade Shakeup: 5 Key Impacts

BOJ Rate Hike Marks a Turning Point for Monetary Policy

On 19 Dec 2025, the Bank of Japan (BOJ) raised its benchmark interest rate from 0.50% to 0.75%, the highest in 30 years, signalling a historic shift away from decades of ultra-accommodative policy. The unanimous decision reflects confidence in persistent inflation and wage growth, and the BOJ has indicated there could be further rate hikes ahead if economic conditions warrant.

Investors React: Calm Markets Amid a Historic Shift

Despite the magnitude of this policy change, markets reacted relatively calmly. Asian stock markets rose modestly, with Japan’s Nikkei and regional indices climbing as investors digested the decision. Meanwhile, the yen weakened slightly against the dollar, as traders balanced expectations of future hikes with uncertainty over global growth and currency markets.

Why the Bank of Japan Raised Rates to a 30-Year High

The BOJ’s decision comes as inflation sustains levels above its 2% target, supported by stubborn food and import price pressures, and wage growth that has become more entrenched. Even as Japan’s economy faces headwinds, the central bank believes gradual rate normalization is necessary to balance inflation control with economic stability.

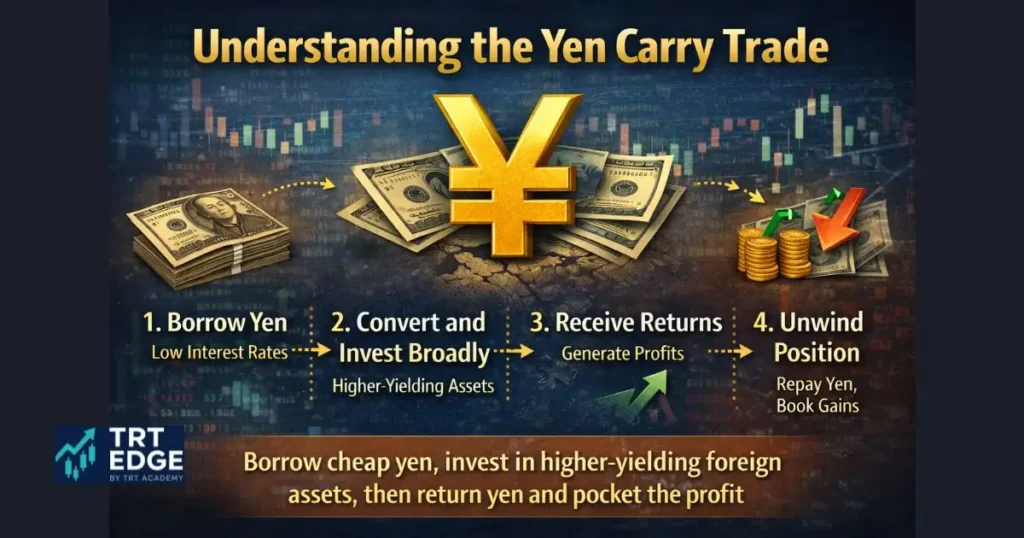

What Is the Yen Carry Trade and Its Connection to BOJ Policy

The Yen Carry Trade involves borrowing low-yield yen to invest in higher-yielding assets abroad. For years, the BOJ’s near-zero policy made this strategy attractive, flooding global markets with cheap yen funding. As the BOJ hikes rates, the profitability of this strategy erodes, potentially triggering unwinding pressures in currency and risk asset markets.

How the BOJ Rate Hike Impacts Carry Trade Dynamics

With higher Japanese rates:

- Borrowing costs in yen rise, reducing the incentive to hold carry positions.

- The yen could strengthen over time as interest rate differentials narrow.

- USD/JPY and other FX pairs may see increased volatility if investors adjust positions.

Effects on Global Markets and Risk Assets

Forex and Bonds

Following the hike:

- The yen’s weakness persisted initially, but future strength is possible if further hikes materialize.

- Japanese government bond yields have climbed, especially the 10-year JGB, reflecting expectations of tighter policy and less central bank intervention in yield markets.

Equities and Risk Sentiment

Global markets showed resilience, with equities climbing modestly. However, if carry strategies unwind more aggressively, higher volatility in equities and FX markets may follow as capital flows adjust.

What Traders and Investors Should Watch Next

- Future BOJ guidance on rate paths — whether the BOJ signals more hikes into 2026.

- USD/JPY and bond yield trends for clues about carry trade unwinding.

- Inflation and wage data from Japan, which will influence BOJ decisions.

Key Takeaways From the BOJ Rate Hike and Yen Carry Trade Shift

- The BOJ’s 30-year high interest rate marks a policy milestone, with further tightening expected.

- The Yen Carry Trade’s mechanics change, potentially reducing speculative funding flows.

- Global markets remain attentive to the BOJ’s next moves, especially in currency and bond markets that could see renewed volatility.