0DTE Iron Condor Strategy for Passive Income

0DTE Iron Condor Options Trade: 17 Oct 2025

The Iron Condor strategy is a popular options trading approach that allows traders to generate steady income from short-term market movements — even when the market remains range-bound. Let’s break down a real-life 0DTE Iron Condor trade executed on 17 October 2025 using XSP (Mini S&P 500 Index Options) using Saxo Markets.

Trade Setup: The 0DTE Iron Condor

Underlying: XSP (S&P 500 Mini Index).

Expiration: 17 Oct 2025 (0DTE — same-day expiry).

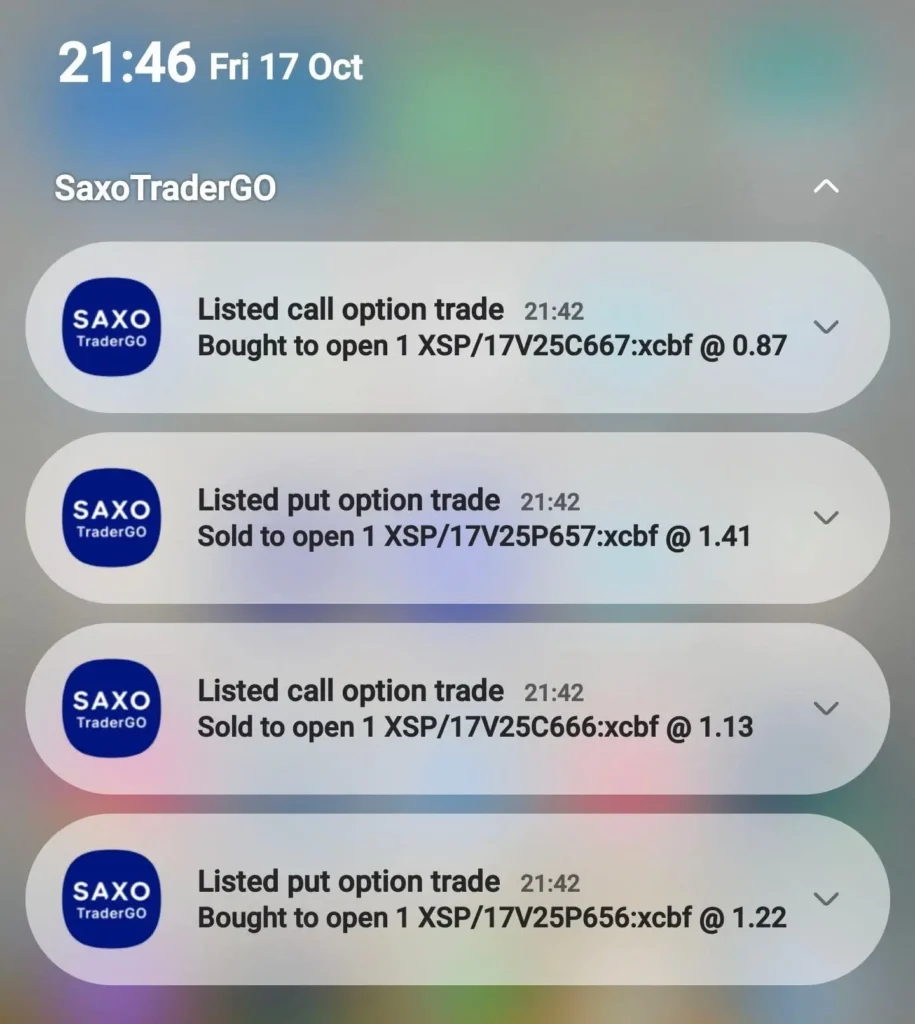

Legs:

- Sold to Open (Call) at Strike 666 at $1.13 Premium.

- Bought to Open (Call) at Strike 667 at $0.87 Premium.

- Sold to Open (Put) at Strike 657 at $1.41 Premium.

- Bought to Open (Put) at Strike 656 at $1.22 Premium.

Net Credit Collected: ($1.13 – $0.87 + $1.41 – $1.22) * 100 = $45 .

Capital at Risk: $100 .

Maximum Loss: $55 .

Return on Risk: $45 / $55 * 100% = 81% .

Profit Range: Between 657 and 666 .

Why the Iron Condor Strategy Works

The Iron Condor options strategy profits when the underlying index — in this case, XSP — stays within a defined range before expiration. The trader sells an out-of-the-money call spread and an out-of-the-money put spread, collecting premium from both sides.

- If the market stays between 657 and 666, all options expire worthless.

- The trader keeps the $45 premium, achieving an 80% return on capital at risk.

- If price moves outside this range, the maximum loss is capped at $55.

This risk-defined setup makes the Iron Condor a favourite for passive income traders, especially for 0DTE (Zero Days to Expiry) strategies, where trades last just a few hours.

Educational Insights

Defined Risk and Reward

Iron Condors offer a clear balance between potential gain and maximum loss. You always know your exposure before entering the trade.

Ideal for Neutral Markets

When volatility is elevated but price movement is expected to stay within a range, Iron Condors allow traders to collect premium efficiently.

0DTE Opportunities

On expiration day, time decay accelerates, giving short option sellers an advantage — as long as price stays within range.

Scalability

With small capital requirements (like this $100 setup), traders can scale gradually while maintaining strict risk control.

Key Takeaway

This 0DTE Iron Condor trade shows how short-term strategies can be structured to deliver consistent, defined-income potential. With $45 profit potential on $55 risk, the Iron Condor strategy continues to be one of the most reliable ways to earn passive income from options — when managed with discipline and precision.

Are you ready to learn how to trade your edge in the live market.? Contact us for a trade-to-learn experience!